If you’re new to AI, ChatGPT, and chatbots and want to harness their power both personally and professionally, we invite you to join WSI’s AI integrationist, Mark Keady, for a 45-minute webinar titled “ChatGPT 101: How to Work Smarter, Not Harder”.” This session is perfect for beginners looking to enhance their work efficiency, boost output, and unlock the full potential of AI to achieve extraordinary results.

Continue readingNavigating the Post-Election Landscape: Supporting Employees and Fostering Unity in the Workplace

Election outcomes impact everyone differently. As leaders, our role is to support, foster empathy, and bring our teams together. Here’s how.

Continue readingMichigan’s $325 Million Semiconductor Boost: Implications for Manufacturers

Michigan’s $325M investment in semiconductor manufacturing is set to create jobs, boost supply chains, and position the state as an industry leader.

Continue readingMichigan Manufacturing Week Targets Youth To Fill Skills Gap

Michigan Manufacturing Week, celebrated from October 4th to 11th, underscores the state’s deep-rooted commitment to manufacturing and its evolving future. Home to more than 600,000 manufacturing workers and over 12,000 companies, Michigan plays a critical role in the nation’s manufacturing landscape. This week’s events focus on showcasing modern manufacturing opportunities and dispelling outdated perceptions of the industry as “dirty” or “low-skill” work. The goal is to inspire young people, emphasizing that skilled trades offer a valuable alternative to traditional college pathways, especially for those looking to avoid student debt while entering high-paying careers

Governor Gretchen Whitmer supports these initiatives by emphasizing the state’s strategy to retain talent and fill the growing demand for skilled workers. New legislation signed during Manufacturing Week furthers these goals by boosting workforce development efforts and creating investment-ready sites across the state. A $1 billion economic development package aims to make Michigan more attractive for large-scale manufacturing projects, leading to job creation and economic growth across multiple sectors State of Michigan | Michigan.gov Michigan MEDC

With an expected 8% increase in manufacturing jobs over the next decade, programs like the Going PRO Talent Fund and Registered Apprenticeships are being utilized to bridge the skills gap. These initiatives provide young people with training and apprenticeship opportunities that lead directly into high-demand careers. By equipping students with practical skills and connecting them to high-paying job opportunities, Michigan aims to ensure that its residents do not need to leave the state to find sustainable careers.

Additionally, Michigan’s push toward advanced sectors such as electric vehicles (EVs) and clean energy aligns with the state’s commitment to creating future-ready jobs. Investments in clean energy have already resulted in over 127,000 jobs, with projections indicating the potential for 41,000 more by 2040 as the state continues to expand in EV production and renewable energy. The emphasis on green manufacturing not only prepares the workforce for future technological demands but also contributes to sustainable economic growth and environmental responsibility(Michigan MEDC).

Governor Whitmer’s legislative actions also complement this growth by supporting various economic and social programs. For instance, bills signed recently include measures to improve funding for training programs, enhance protections for workers, and expand healthcare access in rural areas. These actions contribute to a holistic approach to workforce development, addressing both job training and the wellbeing of workers to ensure a resilient and thriving manufacturing sector(State of Michigan | Michigan.gov

Manufacturing Week is not just a celebration of Michigan’s industrial history but a forward-looking effort to engage the next generation in building the state’s future. By opening doors for young people to explore skilled trades and modern manufacturing technologies, Michigan is positioning itself to remain a leader in innovation and economic opportunity. The week’s events and recent legislative actions together reflect a comprehensive strategy to cultivate a skilled workforce, retain talent, and secure Michigan’s place as a manufacturing powerhouse for years to come(SEMCA Michigan Works!)(State of Michigan | Michigan.gov).

Through these concerted efforts, the state demonstrates that manufacturing is more than machinery; it’s about creativity, problem-solving, and the promise of sustainable, high-paying careers. Michigan Manufacturing Week serves as a pivotal opportunity to introduce youth to these career paths, encouraging them to envision a future in which they contribute to building not only products but also the economy and communities that thrive around them(State of Michigan | Michigan.gov).

Can a President Really Grow Manufacturing?

As the upcoming election draws near, the revitalization of American manufacturing has once again become a central theme in political discourse. Presidential candidates are making ambitious promises to bring back factory jobs and strengthen the industry. However, for manufacturing professionals in Michigan—a state with a rich industrial heritage—the pressing question is: How much can a president truly influence the revival of manufacturing, and what local opportunities are shaping the industry’s future? This recent New York Times article asked that question. In this blog, we examine how the election could affect jobs here in Michigan.

Political Proposals vs. Economic Realities

Former President Donald J. Trump proposes imposing hefty tariffs on nearly all imports to encourage foreign companies to produce goods in the United States. Vice President Kamala Harris, meanwhile, advocates for tax credits and expanded apprenticeships to bolster factory towns and invest in advanced technologies. While these proposals make for compelling campaign narratives, historical evidence suggests that no president can single-handedly dictate the growth of specific industries.

Economic forces such as global market trends, technological advancements, and exchange rates often have a more significant impact on manufacturing. While federal policies can provide incentives and create a favorable environment, the real drivers of manufacturing growth are often found at the state and local levels.

Sun Belt States: The Rise of Business-Friendly Environments

In recent years, manufacturing jobs have been migrating toward the Sun Belt states—such as Texas, Florida, and those in the Southeast—known for their business-friendly climates. These states offer lower taxes, fewer regulations, reliable access to power, and a growing workforce attracted by a lower cost of living and favorable weather.

Nevada, for example, has seen its manufacturing job base grow by more than 13% from early 2020 to March 2023. The state has actively worked to diversify its economy beyond hospitality and entertainment, offering incentives and a welcoming atmosphere for manufacturers. Companies like Alliance North America (ANA) have relocated there, attracted by lower operational costs and a supportive business environment.

“Instead of companies choosing the right location based on all of their other requirements and the presumption that the workers are going to come to them, companies are starting from the presumption of, where are the people moving to?” said Didi Caldwell, president and CEO of Global Location Strategies.

Michigan’s Manufacturing Landscape: Leveraging Local Opportunities

Michigan offers a variety of subsidies and incentives designed to lure businesses and encourage expansion:

Michigan Business Development Program (MBDP): Provides grants, loans, and other economic assistance to businesses that create qualified new jobs and make new investments in Michigan.

Industrial Property Tax Abatement (PA 198): Offers property tax incentives to manufacturers looking to renovate or expand facilities, reducing costs associated with property improvements.

Michigan New Jobs Training Program (MNJTP): Assists employers in training workers for new positions by providing flexible funding to meet the demand for skilled labor.

Michigan Reconnect Program: Aims to help adults over the age of 25 earn a tuition-free associate degree or skilled trade certificate. This program enhances the workforce by providing manufacturers with a pool of skilled workers trained in advanced manufacturing techniques.

Good Jobs for Michigan Program: Provides incentives for businesses that create a significant number of high-paying jobs, aiming to boost the state’s economy and employment rates.

These programs underscore Michigan’s commitment to fostering a business-friendly environment, reducing operational costs, and supporting workforce development—a critical factor for manufacturers considering relocation or expansion.

Case Study: Michigan’s Attractiveness to Manufacturers

Several companies have taken advantage of Michigan’s incentives to grow their operations:

Ford Motor Company’s Electric Vehicle Investment: Ford has announced significant investments in Michigan to expand electric vehicle production, leveraging state incentives to modernize facilities and retrain workers.

LG Energy Solution’s Battery Plant Expansion: In Holland, Michigan, LG Energy Solution is expanding its battery manufacturing plant, supported by state grants and tax incentives aimed at boosting the clean energy sector.

These developments highlight Michigan’s strategic focus on not only preserving its manufacturing legacy but also pivoting towards emerging industries like electric vehicles and renewable energy technologies.

Balancing Local Advantages with National Trends

While the Sun Belt states offer attractive environments for manufacturers, Michigan’s unique combination of incentives, skilled workforce, and infrastructure continues to make it a compelling choice for manufacturing professionals.

Manufacturers in Michigan benefit from:

Skilled Workforce: Michigan boasts a rich pool of skilled labor, thanks to its strong educational institutions and programs like the Michigan Reconnect, which enhances workforce skills by providing tuition-free pathways for adults seeking degrees or certificates in high-demand fields.

Infrastructure and Logistics: The state’s robust transportation network—including major highways, railroads, and ports—facilitates efficient distribution and supply chain operations.

Community and Government Support: Local governments often work closely with businesses to streamline permitting processes and provide assistance, enhancing the ease of doing business.

Cautious Optimism Amid Uncertainty

Despite the positive local factors, the manufacturing industry remains cautious due to broader economic uncertainties and the impending election. Companies are mindful that the outcome could influence taxes, trade policies, and regulations.

“We’re a couple of months away from a huge decision point—who controls Congress and the White House,” said Timothy Fiore, manufacturing business committee chair at the Institute for Supply Management. “I think we’re kind of stuck here until the end of the year.”

Seizing Opportunities in Michigan While Recognizing National Trends

For manufacturing professionals in Michigan, the path to revitalization lies in leveraging state-specific incentives and opportunities while staying aware of national trends like the growth in Sun Belt states. While federal policies and political promises can influence the broader landscape, it’s the tangible, local actions that create a conducive environment for growth.

Michigan’s commitment to supporting manufacturing through various incentives, workforce development programs like Michigan Reconnect, and a business-friendly climate positions it as fertile ground for industry expansion. As the election nears, industry stakeholders should focus on these local advantages, ensuring they are well-positioned to capitalize on the opportunities ahead, regardless of political outcomes.

The Ripple Effect: How the Dockworkers’ Strike Impacts Michigan Manufacturing

On October 1, 2024, tens of thousands of dockworkers along the East and Gulf Coasts initiated a historic strike, marking the first such action in nearly five decades. Members of the International Longshoremen’s Association (ILA) walked off the job at 12:01 a.m., effectively shutting down operations at ports from Maine to Texas, including major hubs like the Port Authority of New York and New Jersey.

The strike centers on demands for higher wages and a ban on certain automated equipment that could replace human labor. The dockworkers’ employers, represented by the United States Maritime Alliance (USMX), have been unable to reach an agreement with the union despite last-minute negotiations.

The affected ports account for more than half of the nation’s container imports, handling everything from consumer electronics to raw materials crucial for manufacturing. Key ports impacted include:

Port Authority of New York and New Jersey: The third-busiest port in the United States.

Port of Savannah, Georgia: A critical gateway for agricultural and manufactured goods.

Port of Houston, Texas: A major hub for energy-related products and industrial machinery.

The roots of the strike trace back to longstanding tensions over wages and the introduction of automation in port operations. The ILA argues that while port employers have reaped significant profits—especially during the pandemic-induced trade boom—the wages of dockworkers have not kept pace with inflation.

“They want to make their billion-dollar profits at United States ports, and off the backs of American I.L.A. longshore workers, and take those earnings out of this country,” ILA President Harold Daggett told the New York Times.

Automation has been a particularly contentious issue. The union is pushing back against the implementation of technologies that could reduce the need for human labor, arguing that it threatens job security and the livelihoods of thousands of workers.

What the Sides Are Looking For

ILA’s Demands:

Wage Increases: The union is seeking a $5-per-hour raise each year over a six-year contract.

Job Security: A ban on certain automated equipment to prevent job losses.

Better Benefits: Improved pension plans and healthcare benefits.

USMX’s Position:

Moderate Wage Increases: Offers that the union deems insufficient.

Automation Implementation: The alliance wants to modernize port operations to increase efficiency.

As of now, negotiations remain at an impasse. The two sides had barely communicated for months before the strike, and recent talks have failed to bridge the gap. The White House has urged both parties to reach a fair agreement but has stated it will not intervene under the Taft-Hartley Act at this time.

Michigan’s manufacturing sector, a cornerstone of the state’s economy, is particularly vulnerable to the strike’s far-reaching ramifications that extend beyond the coastal states. Relying heavily on a complex web of supply chains that often begin at the now-affected East and Gulf Coast ports, Michigan imports over 40% of its manufacturing inputs from international sources, according to the Michigan Economic Development Corporation. Significant volumes of raw materials and components for key industries such as automotive manufacturing, aerospace, and industrial machinery arrive via these critical entry points. Automotive manufacturers depend on imported components like electronics, transmissions, and specialized steel; the aerospace sector relies on precision parts and materials from international suppliers; and industrial machinery production requires components and raw materials not readily available domestically.

With port operations suspended due to the strike, the flow of goods through these vital channels has effectively come to a halt, leading to a cascade of challenges for Michigan manufacturers. Shipments of raw materials are delayed indefinitely, causing immediate concerns over inventory shortages. Shortages of essential components force manufacturers to reduce or halt production lines, resulting in production slowdowns. Additionally, increased transportation costs become a significant issue as alternatives like air freight or rerouting shipments to West Coast ports are not only significantly more expensive but also more time-consuming. These disruptions collectively pose a serious threat to the stability and productivity of Michigan’s manufacturing industries during the strike.

Timeline of the Strike’s Impact:

Understanding the timeline is crucial for planning and mitigation:

- Week 1-2: Manufacturers rely on existing inventory and materials in transit.

- Week 3-4: Inventory levels dwindle. Production schedules are adjusted, and overtime is reduced.

- Month 2: Severe shortages lead to production halts. Layoffs and furloughs may begin.

- Beyond Month 2: Long-term contracts are jeopardized. Companies may face financial instability.

Economic Implications for Michigan Manufacturers

A prolonged strike could have dire economic consequences:

- Revenue Losses: Idle production lines mean lost sales and potential contract penalties.

- Supply Chain Reconfiguration Costs: Sourcing from new suppliers incurs additional costs and potential quality issues.

- Investor Confidence: Uncertainty may deter investment in Michigan’s manufacturing sector.

- Competitive Disadvantages: Global competitors unaffected by the strike may seize market share.

Questions About Automation and Labor Relations

The strike highlights a critical tension between technological advancement and job security—a concern not limited to dockworkers but relevant across all manufacturing sectors.

- Automation Concerns: The push for automation in ports mirrors similar trends in manufacturing, where robotics and AI are increasingly prevalent.

- Labor Relations: Proactive engagement with labor unions can prevent disputes and ensure smoother transitions when adopting new technologies.

Strategic Responses for Manufacturers

Manufacturers can take several steps to mitigate the strike’s impact:

- Assess Inventory Levels: Conduct immediate audits to determine how long operations can continue without resupply.

- Identify Alternative Suppliers: Explore options not affected by the strike, including domestic suppliers or those accessible via unaffected ports.

- Communicate with Stakeholders: Keep employees, suppliers, and customers informed about potential impacts and mitigation strategies.

- Review Contracts: Examine agreements for flexibility in delivery schedules to avoid penalties.

- Advocate for Resolution: Through industry groups like the Michigan Manufacturers Association, push for a swift resolution.

“When we talk about a two- to three-week strike, that’s when the problem starts to get exponentially worse,” said J. Bruce Chan, a transportation analyst at Stifel, in the New York Times.

Long-Term Considerations

Even after the strike ends, its effects may linger:

- Supply Chain Resilience: This event underscores the need for diversification and contingency planning.

- Labor Relations Focus: Investing in positive labor relations can mitigate future disruptions.

- Technology Adoption: Balancing automation benefits with workforce impacts is essential.

Next Steps:

The dockworkers’ strike along the East and Gulf Coasts presents significant challenges for Michigan’s manufacturing sector. Immediate action and strategic planning are crucial to navigate this complex situation. Manufacturers must assess their vulnerabilities, explore alternatives, and engage proactively with all stakeholders to mitigate risks.

At WSI Recruitment and Staffing, we are committed to providing insights and solutions to help you through these turbulent times. Our expertise in workforce solutions positions us as your partner in overcoming these challenges.

WSI Wins ‘Best Mobile Experience’ at Staffing Hub Awards

WSI Wins ‘Best Mobile Experience’ in Staffing Hub’s Inaugural Staffing Agency Website Awards

WSI’s mobile site recognized for fast load times, optimized layout, and user-friendly navigation in the staffing industry’s premier benchmarking report

Kalamazoo, MI — [9/20/2024] — WSI, a leader in staffing and workforce solutions, is proud to announce its recognition as the winner of Best Mobile Experience in Staffing Hub’s inaugural Staffing Agency Website Awards. This award highlights WSI’s commitment to providing a top-tier digital experience for its clients and job seekers alike, placing the company among the best in the staffing industry.

The award comes after a rigorous evaluation of the industry’s top-performing websites, with WSI’s mobile site standing out for several key performance metrics:

- Fast Load Times: WSI’s mobile site ensures that users can access the information they need quickly, reducing delays and optimizing performance. According to Staffing Hub, the average load time for WSI’s mobile site is 30% faster than industry benchmarks.

- Optimized Mobile Layout: Designed with a mobile-first approach, WSI’s site automatically adjusts to provide an intuitive experience across all devices, improving candidate engagement and satisfaction.

- User-Friendly Navigation: The mobile platform enables job seekers and clients to seamlessly explore opportunities and services, with simplified menus and clearly organized content that helps users find what they need without frustration.

In addition to winning Best Mobile Experience, WSI’s website was highlighted in Staffing Hub’s 2024 Staffing Agency Website Benchmarking Report (page 35), which praised the company for its cutting-edge digital presence. With a focus on user experience, the site’s mobile design plays a crucial role in improving application conversion rates and providing a competitive edge in the fast-paced staffing industry.

“We’re honored to be recognized for the mobile experience we’ve created,” said Steve Beebe, Chief Operations Officer. “Our goal has always been to make it easier for candidates and clients to connect with WSI through a platform that’s not only fast and efficient but also incredibly user-friendly. This award is a reflection of our ongoing commitment to digital marketing, technological innovation and excellence in service.”

WSI continues to prioritize digital enhancements, regularly updating and refining its website to meet the evolving needs of users in today’s mobile-driven world. This latest recognition strengthens WSI’s position as a leader in both the staffing and digital marketing spaces.

For more information, please visit www.wsitalent.com or contact Marketing Manager, Bill Fahl, at bfahl@wsitalent.com.

About WSI

WSI is a premier staffing and workforce solutions provider, committed to connecting top talent with leading companies across industries. With a focus on innovation and client success, WSI delivers a personalized approach to staffing, using advanced digital tools to enhance the job search experience.

About Staffing Hub

Staffing Hub is a leading resource for staffing and recruitment industry insights, providing businesses with research, reports, and data-driven strategies for growth.

ChatGPT 101: How to Work Smarter, Not Harder Webinar from WSI

If you’re new to AI, ChatGPT, and chatbots and want to harness their power both personally and professionally, we invite you to join WSI’s AI integrationist, Mark Keady, for a 45-minute webinar titled “ChatGPT 101: How to Work Smarter, Not Harder”.” This session is perfect for beginners looking to enhance their work efficiency, boost output, and unlock the full potential of AI to achieve extraordinary results.

Continue readingMore Than Batteries Draining: Michigan’s EV Dream Collides With Reality

Ford Motor Company’s ambitious plans for the BlueOval Battery Park in Marshall, Michigan, signal a pivotal moment in the state’s role in the electric vehicle (EV) revolution. Despite a scaled-back scope, the project is set to begin producing lithium iron phosphate (LFP) batteries by 2026, with an impressive annual capacity goal of 20 gigawatt-hours. These batteries are expected to power Ford’s EV trucks, mid-sized pickups, and commercial vans, playing a critical role in Ford’s strategy to reduce EV costs by lessening reliance on rare minerals.

Additionally, Ford’s Marshall battery production will prioritize replacing Chinese-made CATL LFP batteries currently used in the standard-range Mach-E. These batteries will likely also be used in the Lightning, e-Transit, and other mid-sized vehicles. Furthermore, Ford is working with LG to source batteries from its plant in Holland, Michigan, which is expanding to supply the Mach-E and e-Transit. This shift to Michigan-based battery production is expected to begin in 2025, making these vehicles eligible for Inflation Reduction Act (IRA) tax credits.

However, Ford’s journey into the EV market has faced bumps along the road. Recently, the company announced a shift by canceling plans for a three-row electric SUV and delaying the release of a new electric F-150 pickup. This decision aligns with a broader cost-cutting initiative in response to slower consumer adoption of EVs. Instead, Ford is focusing on mid-sized pickups and commercial vans, segments where it has traditionally excelled. Additionally, Ford is increasing its investment in hybrid vehicles, which blend electric motors with gasoline engines to offer a more cost-effective transition from traditional combustion engines.

The Marshall plant is expected to create over 1,700 jobs, providing a substantial boost to Michigan’s economy. The facility, spanning 1.8 million square feet, is about 20% complete. While the project has scaled down from its initial projections, the adjustment reflects the broader uncertainties in the EV market. Still, Ford’s commitment remains strong, as seen in their environmental investments. The company has dedicated 245 acres along the Kalamazoo River for conservation and is investing in advanced stormwater and air quality technologies.

Meanwhile, Toyota is taking a more cautious approach to Michigan’s EV scene by focusing on its expertise in hybrid technology. The company is building a $50 million battery lab iat its North American R&D headquarters in York Township, Mich. to evaluate batteries for electric and electrified vehicles in North America. This methodical expansion contrasts with Ford’s aggressive push into full electrification. Toyota’s strategy, backed by over 23 million global sales of electrified vehicles, demonstrates that there are multiple paths to automotive innovation.

As Ford and Toyota tackle the challenges of shifting from traditional engines to electric ones, Michigan is emerging as a hub for this change. Both companies’ projects reflect not only investments in the state’s economy but also commitments to sustainability and automotive innovation.

On another front, Michigan’s battery manufacturing landscape is stirring up debate. The proposed Gotion battery plant near Grand Rapids has raised concerns about foreign investment and national security. The $2.36 billion project, slated for Green Township, has drawn criticism due to its ties to China. Political figures, including GOP Vice Presidential nominee J.D. Vance, have argued that the plant’s connection to the Chinese Communist Party threatens U.S. security. The plant is expected to create 2,350 jobs, but its long-term impact has sparked fierce debate.

The Gotion plant has also raised environmental concerns, with critics pointing to the potential use of hazardous chemicals and high water consumption, which could risk local waterways. This opposition has turned Green Township into a “political battleground,” highlighting the complex challenges Michigan faces in balancing economic development, environmental sustainability, and geopolitical tensions.

Ford’s Marshall cell plant is expected to produce lower-cost LFP cells by 2026, likely replacing Chinese-made batteries in its standard-range Mach-E models. Additionally, Ford’s partnership with LG aims to shift battery production to Michigan, making future vehicles eligible for tax credits under the Inflation Reduction Act (IRA).

Michigan stands at the crossroads of innovation, as its automotive giants push the boundaries of electric mobility while navigating a rapidly changing global landscape.

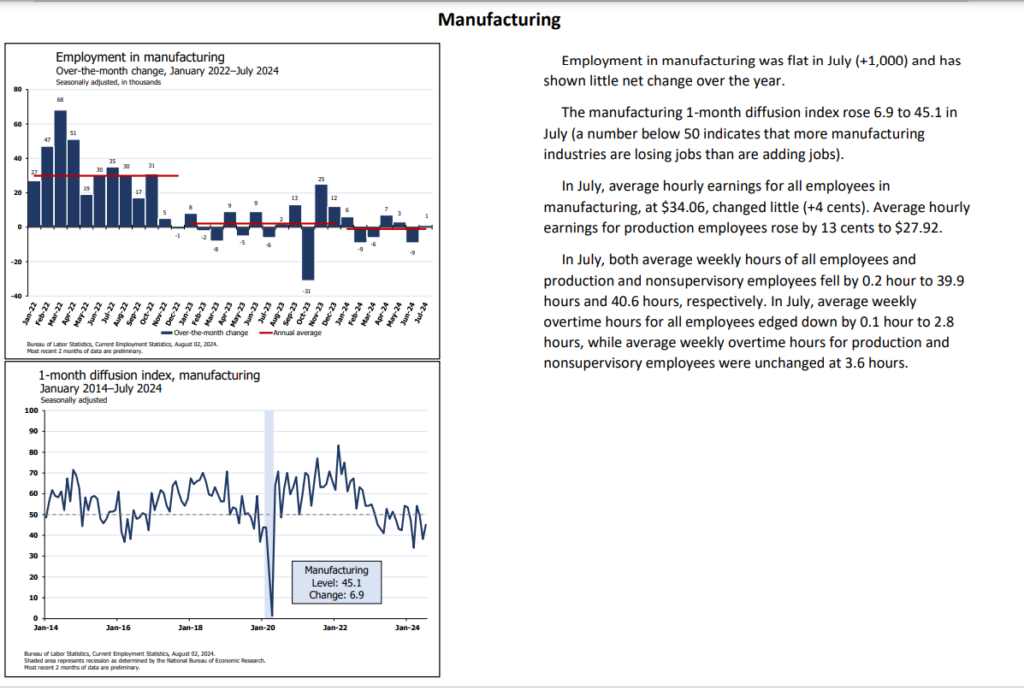

Whiplash Economy: The Impact on Manufacturing Jobs

If 2024 has taught us anything, it’s that the economy is like a rollercoaster you never quite signed up for. Earlier this month, we had a less-than-stellar jobs report—cue the collective sigh of disappointment. The U.S. economy added fewer jobs than expected, falling short of projections and rattling market confidence. For a moment, it felt like the rug was being pulled out from under us again, especially for the manufacturing sector, which has been caught in a downward spiral for most of the year.

Early August Panic and Sudden Recovery

In the days following the jobs report, the market had a brief but intense panic attack, reminiscent of the wild whipsaw reactions we’ve become accustomed to in recent years. The Dow took a dive, dragging spirits down with it. Analysts began sounding the alarm, predicting that the economy was losing steam faster than anticipated. Manufacturing, already battered by supply chain woes and fluctuating costs, braced for another blow as hiring seemed destined for the slow lane.

But just as we were buckling up for more turbulence, the narrative flipped. Inflation data started showing a much-needed cool-down, and suddenly, the Fed’s iron-fisted grip on interest rates seemed ready to loosen. The markets, always fickle, reversed course, with stocks rebounding almost as quickly as they had fallen. The prospect of a Fed rate cut in September emerged, injecting a dose of optimism into an economy that had seemed on the brink just days earlier.

The Tug-of-War on Manufacturing Jobs

For the manufacturing sector, these back-and-forth waves have been particularly jarring. On one hand, the disappointing jobs report raised fears of continued layoffs and a tightening labor market. On the other, the improving economic indicators like cooling inflation and strong retail performance from giants like Walmart offer a glimmer of hope. Could this finally be the turn manufacturing has been waiting for?

There’s a case to be made for cautious optimism. If the Fed does cut rates in September, manufacturers could see lower borrowing costs, which might prompt some to invest in growth and, by extension, jobs. Stable input costs, driven by cooling inflation, would also provide much-needed relief. But let’s not break out the champagne just yet. The sector is still licking its wounds from earlier in the year, and hiring might remain conservative until there’s more certainty that this recovery isn’t just another false dawn.

Navigating the Mixed Signals

The economy’s current state is like a rickety bridge, wobbling under the weight of mixed signals. For every piece of good news, like the potential for a Fed rate cut, there’s a reminder of the fragility that still exists, such as the weak jobs report. Manufacturing, as always, is caught in the middle. The sector’s recovery will likely be slow and uneven, with businesses cautious about adding to their workforce until they see sustained signs of stability.

In the meantime, manufacturing workers and employers alike will need to stay agile, navigating these unpredictable waters with a mix of hope and pragmatism. The economy may be sending out mixed signals, but one thing is clear: the ride is far from over.